Apple High-Yield Savings Account Review: Is It Worth It?

I was a little surprised when Apple announced they were offering a high yield savings account.

But when you consider how we use our phones today, it’s no wonder Apple wants to get into the banking business. We tap to pay, why not do it with an Apple Card instead of a Visa or MasterCard?

It’s a natural extension to start offering banking services too.

If you’re an Apple customer, you can earn a higher yield on your savings too. Apple originally teamed up with Goldman Sachs to bring customers the Apple High-Yield Savings Account, which pays above-average interest on your savings. (there is news that they are ending the relationship in 12-15 months, but we don’t yet know who will be taking over – the information below is accurate as of publishing but could change)

But how does the Apple High-Yield Savings Account work, and how does it compare to similar products from other financial institutions? We answer those questions and more in this Apple High-Yield Savings review.

Table of Contents

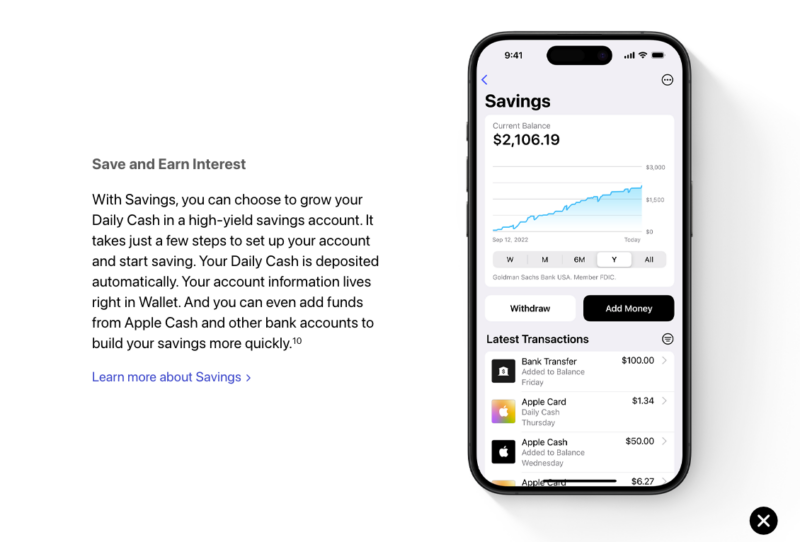

In April 2023, technology giant Apple entered the financial arena with its Apple High-Yield Savings Account. The account is currently paying 4.15% APY on all account balances. In addition to the competitive APY, there are no fees and minimum balance requirements.

You can fund your Apple Savings directly from a linked bank account or through cash back that you earn with the Apple Card credit card (more on that later).

There is a catch with this account, however. To participate, you must be both an Apple iPhone owner and an Apple Card customer. The Apple High-Yield Savings Account is not available to the general public.

In case you’re unfamiliar, here’s a close look at the Apple Card.

The Apple Card

The Apple Card is key to the Apple High-Yield Savings Account. It’s a cash-back credit card allowing you to earn up to 3% on purchases. What’s more, the cashback is credited to your account on the very same day rather than at the end of the month, as is typical with other cash back credit cards.

Since the Apple Card is a Mastercard, it can be used anywhere in the world where Mastercard is accepted (which is just about everywhere).

The Apple Card pays 3% cash back on anything you buy from Apple and select merchants, such as Uber and Uber Eats, Walgreens, T*Mobile, Panera Bread, Ace Hardware stores, Nike, and Exxon-Mobile. You can earn 2% cash back on all other purchases using the Apple Card with Apple Pay. If Apple Pay isn’t used, 1% cash back applies on all other purchases.

There are no annual fees, foreign transaction fees, or late fees.

Apple High-Yield Savings Features

Here’s a closer look at the key features of the Apple High-Yield Savings Account:

- No initial deposit required

- Individual accounts only; joint accounts are not available at this time

- No monthly or annual fees, foreign transaction fees, or late fees

- No ATM access

- All accounts are FDIC-insured for up to $250,000 per depositor. FDIC insurance is offered provided through Goldman Sachs

- You can contact customer service by phone at 877-255-5923

The Apple Card can serve as a limited debit card of sorts with your Apple High-Yield Savings account. It is a credit card, but you can transfer funds from your Apple Savings to the card for spending purposes. You can purchase with the card anywhere Apple Pay is accepted, but you cannot make ATM withdrawals.

How to Open an Apple High-Yield Savings Account

If you have an iPhone and an Apple Card account, you can open an Apple High-Yield Savings Account through your Apple Card in your Apple Wallet. You’ll need to provide your Social Security number, home address, and other information as required.

Account funding: You can connect an external bank account and make transfers to your Apple Savings or the cash back you earn from making purchases with your Apple Card.

Withdrawals: This is where the Apple High-Yield Savings Account gets a bit clunky. While you can transfer cash instantly from the account to your Apple Card, withdrawing actual cash is more problematic. There is no ATM access for cash, and funds must be transferred to a linked external bank account, which can take up to three business days to complete.

Apple High-Yield Savings Pros & Cons

You can find Apple products, from iPhones and iPads to Airpods and MacBook laptops, in almost every home in America. But will Apple have the same success with its high-yield savings account? It has some definite positives, but there are drawbacks. Here’s our list of pros and cons:

Pros:

- No minimum balance requirements

- The current 4.15% APY is competitive.

- No monthly account fees

- Account balances are FDIC-insured

- Apple Card cash back can be transferred to your account

Cons:

- Only available to iPhone and Apple Card users

- Withdrawals aren’t as convenient as other savings accounts (no ATM access)

- Transfers to a linked bank account can take up to three business days.

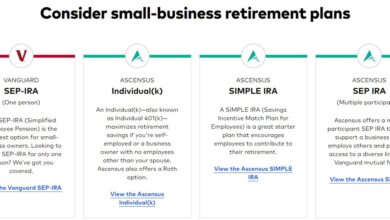

Apple High-Yield Savings Alternatives

if you don’t have an iPhone and an Apple Card, you won’t be eligible for the Apple High-Yield Savings Account. Here are some high-interest savings account alternatives worth considering if Apple’s product doesn’t work for you.

Customers Bank

Customers Bank is an online, full-service bank offering personal, small business, and commercial banking. Their product lineup includes checking and cash management accounts and business loans. Deposits with Customers Bank are FDIC-insured.

Through Raisin, they currently pay 5.30% APY on their high-interest savings account. The minimum opening balance is just $1.

Learn More About Customers Bank

CloudBank

CloudBank 24/7 is a division of Third Coast Bank SSB, which is an FDIC-insured bank. When you make deposits into your CloudBank 24/7 savings account, the funds are held on deposit with Third Coast Bank. As with Customers Bank, there are no monthly fees, and the minimum opening balance is only $1.

You can open a CloudBank 24/7 High Yield Savings account online through Raisin. At this time, the account is paying a healthy 5.26% APY, which is considerably higher than the Apple Savings offer.

Blue Federal Credit Union

Blue Federal Credit Union is a federally chartered credit union with over 100,000 members, with most based in Colorado and Wyoming. They offer a money market account online through Raisin that currently pays 5.15% APY. While it isn’t technically a savings account, it operates in much the same way. There are no monthly account fees and the minimum opening deposit is only $1. There are no monthly transaction limits, although Blue FCU reserves the right to reinstate limits at any time.

FAQs

Is Apple High-Yield Savings worth it?

The number one drawback of the Apple High-Yield Savings is that it’s only available to iPhone users with an Apple card. You will not be eligible to open an account if you don’t have both. This isn’t entirely surprising, given Apple’s history of “forcing” customers into the Apple ecosystem.

Otherwise, the Apple High-Yield Savings Account seems best suited as the type of savings account you will not need to access for quick funds. The transfer process from Goldman Sachs into a linked bank account can take several days, resulting in a slow funds access process; however, the 4.15% APY is competitive, and there are no fees to worry about.

How much will you make on $1,000 in an Apple High-Yield Savings account?

With an annual return of 4.15% APY, you can expect to earn slightly more than $41.50 after holding $1,000 in the account for a full year.

How safe is Apple Bank for savings?

First, there is no such thing as Apple Bank since Apple is a technology company and not a bank in any sense. They can provide customers with a high-yield savings account through their partnership with Goldman Sachs, which is a safe and 100% legitimate financial institution. Remember that any funds you have on deposit are FDIC-insured for up to $250,000 per depositor.

Should You Open an Apple High-Yield Savings Account?

The Apple High-Yield Savings Account has a competitive interest rate, though it isn’t one of the highest in the industry. With so many no-fee high-interest savings accounts available today, if you don’t already have an iPhone and an Apple Card, it’s not worth setting those things up for the sake of an Apple Savings account.

That said, the account is worth considering if you’re fully entrenched in the Apple ecosystem, have an Apple Card, and use Apple Pay to make purchases every chance you get.

Learn more about the Apple High-Yield Savings account here, or apply for an Apple Card to make yourself eligible for an Apple High-Yield Savings account.

Apple

Strengths

- No minimum balance requirements

- The current 4.15% APY is competitive

- No monthly account fees

- Account balances are FDIC-insured

- Apple Card cash back can be transferred to your account

Weaknesses

- Only available to iPhone and Apple Card users

- No ATM access

- Transfers to a linked bank account can take up to three business days

Other Posts You May Enjoy:

Visible Review: Affordable Unlimited Data Plans and More

Visible Wireless is a Verizon-owned prepaid cell phone company offering affordable unlimited data plans and no contracts. Users also benefit from access to the Verizon network. Is Visible worth switching to? We break down its plans, key features, and pros and cons. Learn more.

Milli Review: No-Fee Banking and a High Savings APY

Milli is an online banking app from First National Bank of Omaha. It offers no-fee banking with a high APY on savings. But it lacks some of the features offered by top online banks like Chime and Ally. Is Milli worth signing up for? Our Milli app review covers the key features, pros and cons, pricing, and more.

PenFed Credit Union Promotions: up to $750 Deposit Bonus

PenFed Credit Union is a well-regarded credit union that has an offer that can net you up to $750 if you have a large amount to deposit. See the details of this offer and whether it makes sense for you.

Ditch financial practices that no longer serve you

The financial practices you did in your twenties may no longer suit you as a age into your thirties, forties, and fifties. It’s OK to revisit, ditch, and revise those practices so they benefit your finances, rather than be a chore.

About Kevin Mercadante

Since 2009, Kevin Mercadante has been sharing his journey from a washed-up mortgage loan officer emerging from the Financial Meltdown as a contract/self-employed “slash worker” – accountant/blogger/freelance blog writer – on OutofYourRut.com. He offers career strategies, from dealing with under-employment to transitioning into self-employment, and provides “Alt-retirement strategies” for the vast majority who won’t retire to the beach as millionaires.

He also frequently discusses the big-picture trends that are putting the squeeze on the bottom 90%, offering workarounds and expense cutting tips to help readers carve out more money to save in their budgets – a.k.a., breaking the “savings barrier” and transitioning from debtor to saver.

Kevin has a B.S. in Accounting and Finance from Montclair State University.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.