Fintech Robos Eyes MENA with Retail Investment Workshop

Fintech Robos, the entity providing digital savings solutions, is gearing up to host an event for top-tier executives in the finance sector in Saudi Arabia. This event aims to revolutionize the approach towards long-term retail investments across the Middle East and North Africa region.

According to a report published on Zawya, this initiative dubbed the “Robo Advisor & Goal-Based Investing Workshop & Demo”, is scheduled for February 27, 2024, at the Hilton Riyadh Hotel in Saudi Arabia.

Ebrahim K Ebrahim, the CEO of Fintech Robos, mentioned: “We’re already in digital life and digital lifestyles where businesses are mobile and online first. The need for financial institutions offering savings and investments to adopt robo advisory with personalized services has never been more critical.”

Insights on Robo Advisor Solution

The workshop encompasses four comprehensive sessions designed to equip attendees with market insights. The topics range from understanding shifting retail dynamics to devising strategies for engaging users in the digital era. Additionally, participants will evaluate product design, user experience, and a live demonstration of a complete robo-advisor solution.

The emergence of robo-advisors has significantly transformed the investment landscape. These digital platforms leverage cutting-edge technology and sophisticated algorithms to automate investment advisory and portfolio management. Robo-advisors have disrupted traditional investment management methods by offering cost-effective and personalized guidance.

The Impact of Personalized Robo-Advisors

Robo-advisors serve as digital platforms utilizing algorithms and artificial intelligence to design investment strategies tailored to individual preferences and financial goals. According to a report by Finance Magnates, the impact of robo-advisors lies in the democratization of investment services.

A standout feature of robo-advisors is the ability to offer personalized investment advice. These platforms analyze investors’ risk tolerance and financial objectives. Additionally, they provide transparent fee structures, empowering users to make informed decisions and compare costs across various platforms.

In June, Revolut introduced a robo-advisor to democratize investment opportunities for its American users. These algorithms and computer programs redefine traditional investment strategies by providing personalized advice and managing portfolios at minimal costs.

The platform’s appeal lies in its ability to simplify investment processes, enabling individuals to seamlessly navigate financial markets, the company said. The advisor uses responses collected from users to gauge risk tolerance, creating a customized investment portfolio across five diversified options.

Fintech Robos, the entity providing digital savings solutions, is gearing up to host an event for top-tier executives in the finance sector in Saudi Arabia. This event aims to revolutionize the approach towards long-term retail investments across the Middle East and North Africa region.

According to a report published on Zawya, this initiative dubbed the “Robo Advisor & Goal-Based Investing Workshop & Demo”, is scheduled for February 27, 2024, at the Hilton Riyadh Hotel in Saudi Arabia.

Ebrahim K Ebrahim, the CEO of Fintech Robos, mentioned: “We’re already in digital life and digital lifestyles where businesses are mobile and online first. The need for financial institutions offering savings and investments to adopt robo advisory with personalized services has never been more critical.”

Insights on Robo Advisor Solution

The workshop encompasses four comprehensive sessions designed to equip attendees with market insights. The topics range from understanding shifting retail dynamics to devising strategies for engaging users in the digital era. Additionally, participants will evaluate product design, user experience, and a live demonstration of a complete robo-advisor solution.

The emergence of robo-advisors has significantly transformed the investment landscape. These digital platforms leverage cutting-edge technology and sophisticated algorithms to automate investment advisory and portfolio management. Robo-advisors have disrupted traditional investment management methods by offering cost-effective and personalized guidance.

The Impact of Personalized Robo-Advisors

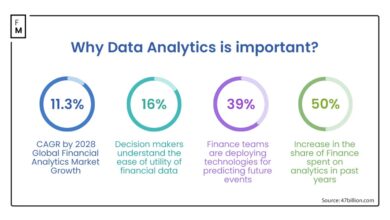

Robo-advisors serve as digital platforms utilizing algorithms and artificial intelligence to design investment strategies tailored to individual preferences and financial goals. According to a report by Finance Magnates, the impact of robo-advisors lies in the democratization of investment services.

A standout feature of robo-advisors is the ability to offer personalized investment advice. These platforms analyze investors’ risk tolerance and financial objectives. Additionally, they provide transparent fee structures, empowering users to make informed decisions and compare costs across various platforms.

In June, Revolut introduced a robo-advisor to democratize investment opportunities for its American users. These algorithms and computer programs redefine traditional investment strategies by providing personalized advice and managing portfolios at minimal costs.

The platform’s appeal lies in its ability to simplify investment processes, enabling individuals to seamlessly navigate financial markets, the company said. The advisor uses responses collected from users to gauge risk tolerance, creating a customized investment portfolio across five diversified options.